Staying SMART about Solar in 2025: Massachusetts’ New Solar Program and Federal Tax Updates Explained

On June 20, 2025, Massachusetts launched the newest version of its statewide solar incentive program, the Solar Massachusetts Renewable Target (SMART) 3.0. This update to the SMART program (225 CMR 28.00), filed as an emergency regulation, immediately replaces SMART 2.0 (225 CMR 20.00) and is designed to accelerate solar adoption across residential, commercial, nonprofit, and public sectors. Beyond lowering energy costs, SMART 3.0 aims to ease grid congestion, improve energy reliability, and reduce greenhouse gas emissions to advance the state’s legally binding climate goals.1

This new phase of the program arrives at a pivotal moment. Federal tax incentives for solar projects are set to phase out completely by 2027, limiting financing options and making state-level programs, like SMART 3.0, even more crucial to funding solar.

For nonprofits, municipalities, and other organizations, SMART 3.0 represents a timely opportunity to secure long-term savings and advance organizations’ energy goals while federal incentives remain available. Understanding how SMART 3.0 interacts with federal tax credit changes will be key to maximizing benefits, ensuring projects are well-positioned for the future.

This is a time-sensitive moment where strong planning and quick action are essential to realizing full benefits offered by the federal government before they are phased out.

Table of Contents

- SMART 3.0 Program Updates

- Program Structure Reform

- Incentive & Adders

- H.R.1 Tax Credit Phase Out

- Key Dates & Timeline

- Safe Harbor Rules

- Foreign Entities of Concern Compliance

- What’s Next?

- Stay Connected & Informed

SMART 3.0 Program Updates

Program Structure Reform

SMART 3.0 now incorporates an annual assessment to evaluate program performance against market conditions, project costs, and environmental objectives. Each year, regulators will review the total program capacity, allocations by utility, base incentive rates, adders, and the fixed incentive for projects under 25 kW and make changes as appropriate for the next program year. This process is designed to maintain program stability while allowing adjustments that reflect shifts in the solar market.

For Program Year 2025 which will kick off with a two-week application window opening on October 15th, 2025, SMART 3.0 establishes 900 MW of capacity2. To broaden access, any project under 25 kW, along with behind-the-meter projects under 250 kW, are not currently subject to capacity caps. Annual set-asides are included for certain larger project types to support a balanced portfolio. This structure is intended to sustain growth in large-scale solar development while maintaining streamlined participation for small and residential systems.

Once the statewide capacity for 2025 is reached, new project applications will be placed on a waitlist. This system is designed to encourage timely submissions and prioritize projects that are ready to build. Projects on the 2025 waitlist will receive priority consideration before new applications submitted for the 2026 program year. Applications for Program Year 2026 will be accepted during a 10-day window starting on January 2, 2026.

Incentives & Adders

Along with an annual assessment, SMART 3.0 strengthens Massachusetts’ solar incentive program by using an annual cost analysis to set incentive levels and giving priority to rooftop, canopy, and brownfield projects. Additional compensation is available for rooftop systems over 1 MW and projects with battery storage.

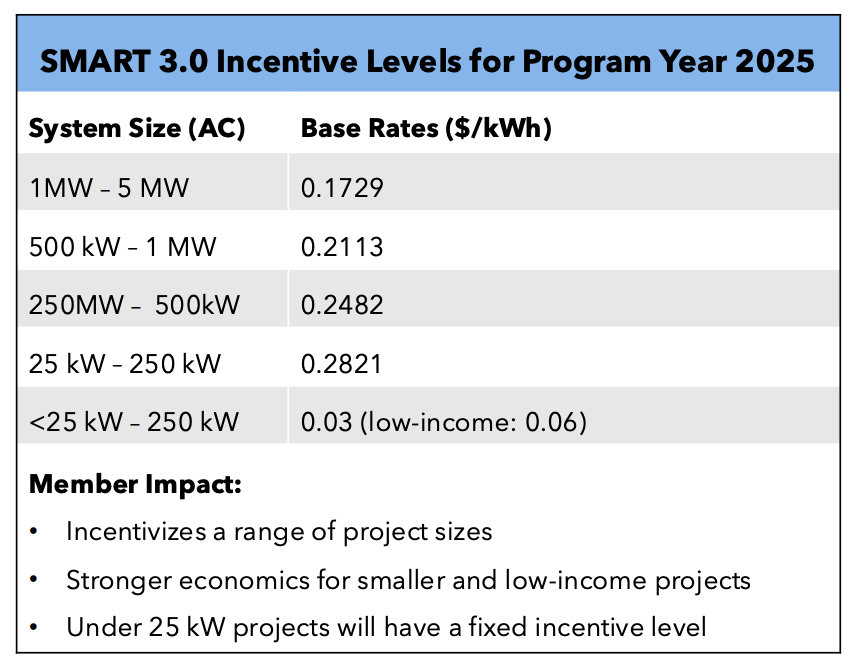

Incentives continue to be performance-based, with payments tied to the actual kilowatt-hours (kWh) a system produces. This provides system owners with a reliable, production-driven revenue stream over a 20-year period. The incentive and adder levels for Program Year 2025 are as follows:

SMART 3.0 introduces higher incentives than its predecessor, SMART 2.0, arriving at a vital moment considering the sweeping changes brought by Congress’ H.R. 1, often referred to as the ‘One Big Beautiful Bill.’ SMART 3.0 now allows up to a 20% year-over-year adjustment to its annual incentives and adders, double the originally proposed 10%, to help offset the funding gap created by the federal tax credit phase-out.

H.R.1 Tax Credit Phase Out

Key Dates & Timeline

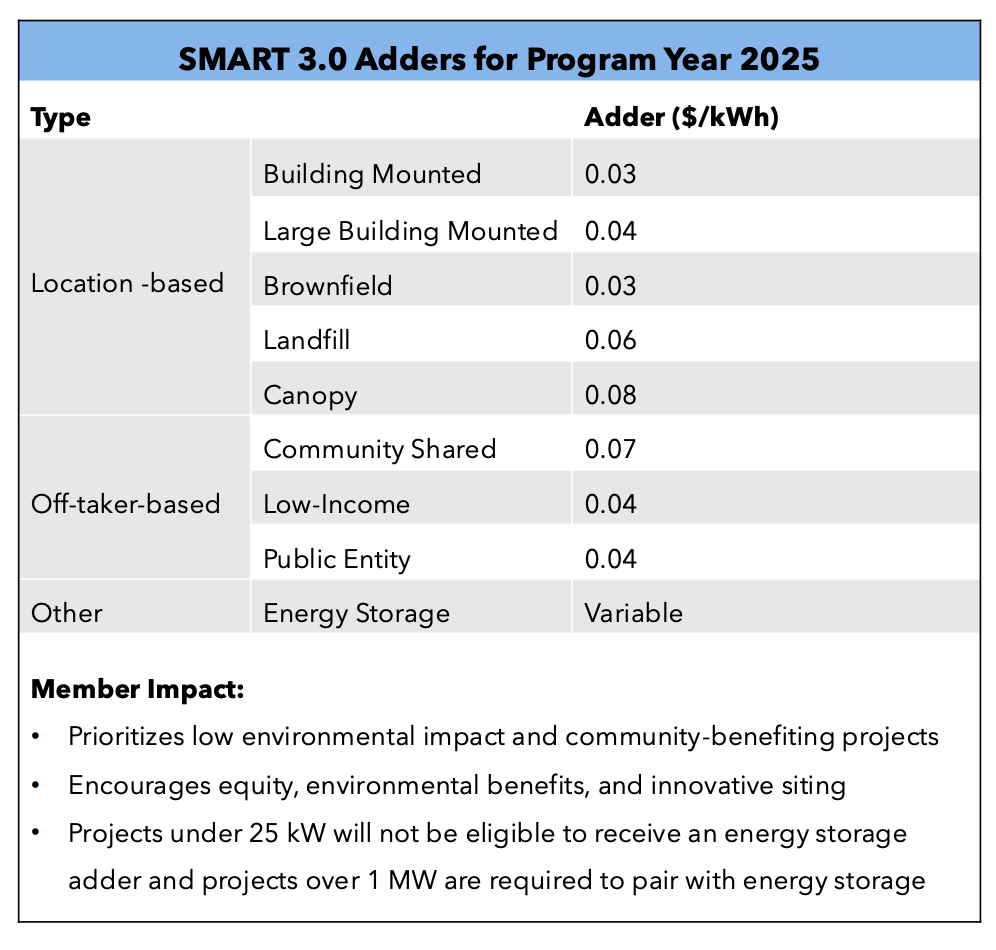

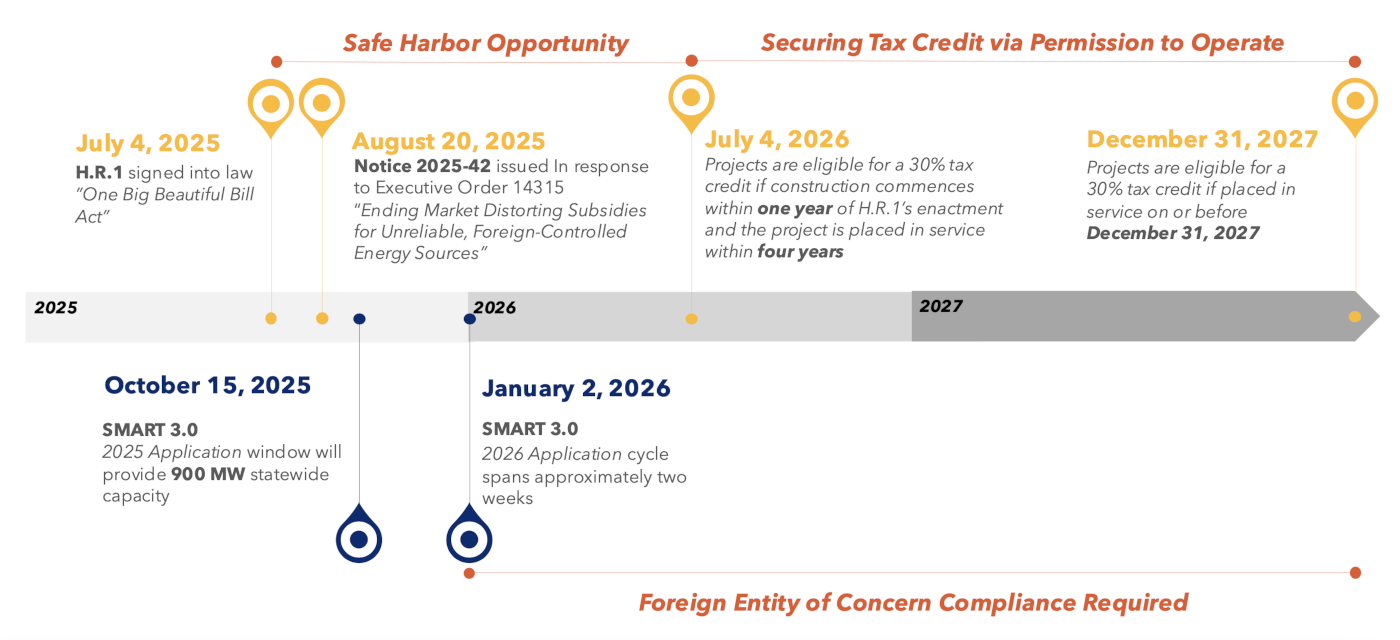

The recently enacted bill, H.R.1, and subsequent Executive Order 14315, introduce fundamental changes to how clean energy projects in the United States can qualify for federal tax credits while they are still available. Changes from this legislation (H.R.1) impose new compliance standards, project eligibility timelines and restrictions related to resources sourced from foreign entities of concern (FEOCs).

On July 4, 2025, the Trump Administration signed H.R.1, the “One Big Beautiful Bill Act”, into law, including wide-ranging changes to federal tax policy, healthcare, immigration, and energy programs. For the energy sector, H.R.1 modifies or repeals several provisions of the Inflation Reduction Act (IRA), which expanded clean energy tax credits to reduce project costs and support decarbonization.

H.R.1 repeals the Clean Electricity Production Tax Credit (PTC) and Clean Electricity Investment Tax Credit (ITC) of the IRA3 as they apply to wind and solar energy projects. These provisions, which currently provide up to a 30% tax credit for qualifying facilities, will remain available to wind and solar projects if they meet one of the following conditions:

- Projects are placed in service by December 31, 2027, or

- Projects begin construction (see below) by July 4, 2026, and are placed in service within four years.

The ITC & PTC continue to be available for other eligible technologies, including standalone energy storage, through 2032 as authorized under the IRA.

For more details on H.R. 1, see our recent blog, “One Big Beautiful Bill: What H.R. 1 Means for Clean Energy and Tax Reform.” Notice 2025-42, in response to Executive Order (EO) 14315, provides further guidance on how to qualify a clean energy project for federal tax credits before they are phased out by precisely defining what must be achieved to satisfy the begin construction requirement.

Safe Harbor Rules

Safe harbor is a legal/regulatory provision that offers protection from penalties or loss of benefits if certain conditions are met. In the clean energy tax credit context, safe harbor rules give developers a clear pathway to demonstrate compliance (for example, by meeting spending or construction benchmarks) so they can preserve eligibility for incentives.

The Department of Treasury and IRS’s guidance (Notice 2025-42) reinforces strict compliance with the tax credit termination deadlines. Importantly, it clarifies what qualifies as the beginning of construction, a key factor in maintaining eligibility for these credits.

Historically, the IRS allowed beginning of construction to be reported as: (i) by starting physical work of a significant nature (Physical Work Test), or (ii) by paying or incurring 5% or more of the total cost of the facility (5% Safe Harbor), but EO 14315 and Notice 2025-42 change this understanding. Safe Harbor requirements are now written as follows:

Safe Harbor Provisions for < 1.5 MW Solar Projects

Under the current guidance, small solar projects with a nameplate capacity of 1.5 MW AC or less may qualify for an exception to the new beginning of construction requirements as established under EO 14315. These low output projects are allowed to use either the Physical Work Test or the 5% Safe Harbor Test to demonstrate the start of construction.

This guidance allows projects smaller than 1.5MW AC (typically schools, municipalities, nonprofits, and community-scale solar developers) to continue qualifying for the ITC by meeting the more flexible 5% Safe Harbor Rule.

This eases compliance by letting smaller projects lock in credits through early expenditures instead of demonstrating immediate on-site construction.

Safe Harbor Provisions for > 1.5 MW Solar Projects

The Physical Work Test is now the exclusive method for qualifying projects over 1.5 MW AC, making “preliminary” activities ineligible toward beginning of construction requirements, including planning, permitting, financing, site clearing, test drilling, or removal of old equipment. Starting construction therefore is to be determined by the type of work performed, not the amount or cost spent. Qualifying activities include:

- Offsite physical work: the manufacture of components, mounting equipment, support structures such as racks and rails, inverters, and transformers or other power conditioning equipment.

- Onsite physical work: installation of racks or other structures to affix panels, collectors, or solar cells to a site.

**Removing existing materials does not count towards satisfying this test**

Developers must also meet the Continuity Requirement, demonstrating an uninterrupted program of construction (with exceptions for delays like weather, public safety, permitting, supply chain, or interconnection).

Foreign Entity of Concern Compliance

Under H.R.1, the definition of a Foreign Entity of Concern (FEOC) is expanded through the creation of a new classification: Prohibited Foreign Entities (PFEs). PFEs are categorized into two distinct groups: specified foreign entities (SFEs) and Foreign-Influenced Entities (FIEs), each with specific criteria aimed at identifying entities that may pose risk to U.S. national security, economic independence, or clean energy supply chains. Specified Foreign Entities (SFEs) are companies with ties to countries like China, Russia, Iran, or North Korea, or those restricted under U.S. law for reasons such as forced labor, national security risks, or defense contract bans. Foreign-Influenced Entities (FIEs) are businesses where SFEs have significant ownership, debt, or control over them.

Any entity that falls within either category is considered a Foreign Entity of Concern under H.R.1 and may be subject to restrictions on eligibility for certain federal clean energy tax credits and incentive programs. In this context, entities would include vendors who provide components for clean energy projects. This framework is intended to reinforce domestic supply chain security and reduce reliance on entities linked to strategic competitors or human rights concerns. Projects that begin construction after December 31, 2025, may be disqualified if they include any foreign components, designs, or financing from prohibited countries.

PowerOptions is working closely with developers to ensure our Members’ projects stay compliant with the latest guidelines. Members considering solar investments should connect with PowerOptions as soon as possible to align project timelines and secure eligibility for these tax credits.

Preserving Transferability of Tax Credits & Elective Pay

One notable continuity under H.R.1 is the preservation of the IRA’s credit transferability and elective pay provisions. Transferability allows clean energy developers to sell their tax credits to unrelated third parties, helping projects with limited tax liability, such as those led by nonprofits, schools, or municipalities, access financing through credit monetization. Elective Pay, on the other hand, enables tax-exempt entities like 501(c)(3) nonprofits to directly benefit from tax credit incentives, even though they don’t pay federal income taxes in the traditional way.

However, tax credits may not be transferred to entities with affiliations to certain foreign governments.

What’s Next?

The launch of SMART 3.0 combined with recent federal policy shifts mark a turning point for solar development in Massachusetts and across the United States. Organizations that move quickly to take advantage of enhanced state incentives and federal tax credits, before they phase out in 2027, are positioned to benefit the most. For nonprofits, municipalities, and other public entities, early project planning is essential to secure the greatest long-term savings.

The next three months will be critical for aligning project timelines and maximizing the value of these time-limited opportunities.

Stay Connected & Informed

At PowerOptions, we are continuously monitoring federal and state energy policy changes to ensure we can deliver the most meaningful benefits to our Members and help them achieve their energy goals.

If you want to explore solar or have questions about what these legislative changes mean for you, we are here to help. Contact our Alternative Fuel Analyst, Jahnavi Mahindra at jmahindra@poweroptions.org